Audi CEO abandons plan to sell Ducati motorcycle brand

INGOLSTADT, Germany (Reuters) – German Audi NSUG.DE has abandoned plans to sell its Italian motorcycle brand Ducati, chief executive Rupert Stadler said, in a sign of confidence the automaker expects to be able to bear the costs of its transformation.

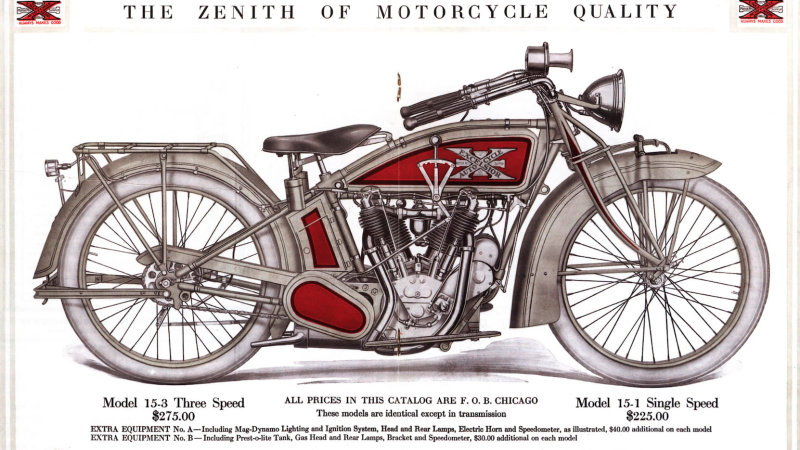

The logo of the Italian motorcycle manufacturer Ducati can be seen in Dietlikon, Switzerland on October 11, 2016. REUTERS / Arnd Wiegmann

Steps to cut costs by 10 billion euros ($ 11.8 billion), cut red tape and deepen ties with other Volkswagen owners VOWG_p.DE The Porsche brand “is gradually increasing our financial and organizational leeway for strategic realignment,” Managing Director Rupert Stadler told reporters.

So there is no economic need to sell Ducati, Stadler said. Volkswagen asked banks to assess options for Ducati and transmission maker Renk earlier this year as it seeks to become more nimble in its transition to electric and self-driving cars following its fraud scandal on vehicles. diesel emissions.

“I can assure you that Ducati belongs to the Audi family,†said Stadler. “Ducati is the perfect implementation of our premium philosophy in the motorcycle world. “

Plans were already at a standstill over the summer when VW’s powerful unions, backed by controlling Porsche-Piech families, objected to the logic and the need to sell assets given financial resilience. of the group.

Investors and potential buyers of Ducati, however, expect VW to change its mind again and possibly go for the sale of the asset that they believe is of least strategic importance to VW.

“For Volkswagen’s powerful works council, this could be an easy bargaining chip that they could come up with to push through something completely different,” said a person familiar with the matter.

Investors have long favored divestitures to simplify the structure of the VW group and strengthen the ability of its management to push through structural changes against the will of the unions.

Audi, which owns Ducati and Italian supercar maker Lamborghini, reported higher operating profit and revenue for the first nine months last month, helped by growing automotive demand in higher-margin markets. Western Europe and the United States.

While pushing the costly shift to zero-emission and autonomous technologies, clinging to the profitable Ducati division and the lucrative Lamborghini brand has become more important, Stadler said.

“Caring for a high-end bouquet is as difficult as the job of a gardener,†Stadler said. “Therefore, I am satisfied with every new flower, every promising new branch,” he added, predicting that Lamborghini sales would double on the back of its new sport utility vehicle.

Separately, Stadler said Audi will spend nearly half a billion euros over the next eight years to train staff for the digital age, with stages of development and hiring of experts such as automotive application designers and automotive robotics specialists.

To keep costs under control, Audi wants to keep its workforce stable, at least over the next 2-3 years, even though it plans to have more than 20 electrified vehicles on the market by 2025 and is embarking on the services of digitalized mobility, said the CEO.

With two-thirds of Audi’s sixty or so models by 2025 still expected to be combustion-engine cars, tighter carbon dioxide (CO2) rules will pose the “biggest risk” in the years to come. coming, he said, adding that Audi would face 1 billion euros. fines if the average CO2 emissions of its fleet exceed EU limits by no more than eleven grams per kilometer.

Audi overhauled its whistleblower system to make it easier for national and international staff to report illegal behavior and set up a permanent investigation office.

Audi plans early next year to disband a task force set up to monitor patches for 850,000 diesel-powered cars that the automaker said needed updates with engine control software in July. emissions to avoid potential driving bans.

“This is a sign that we can slowly move from crisis mode to standard operation,” Stadler said, predicting that the checks should be completed by the end of the first quarter.

Additional reporting by Arno Schuetze; edited by Alexander Smith